It’s Not Your Father’s Stock Market

This is the “Age of Accelerations,” according to Tom Friedman in his new book Thank You for Being Late. In the book Friedman is referring to the dramatic pace of change in the age of the internet and cloud technologies. As most of us have noticed, the dramatic pace of change is affecting everything in our lives. It has affected our vocations and our avocations, how we travel, how we learn, our methods of communication, and how we shop.

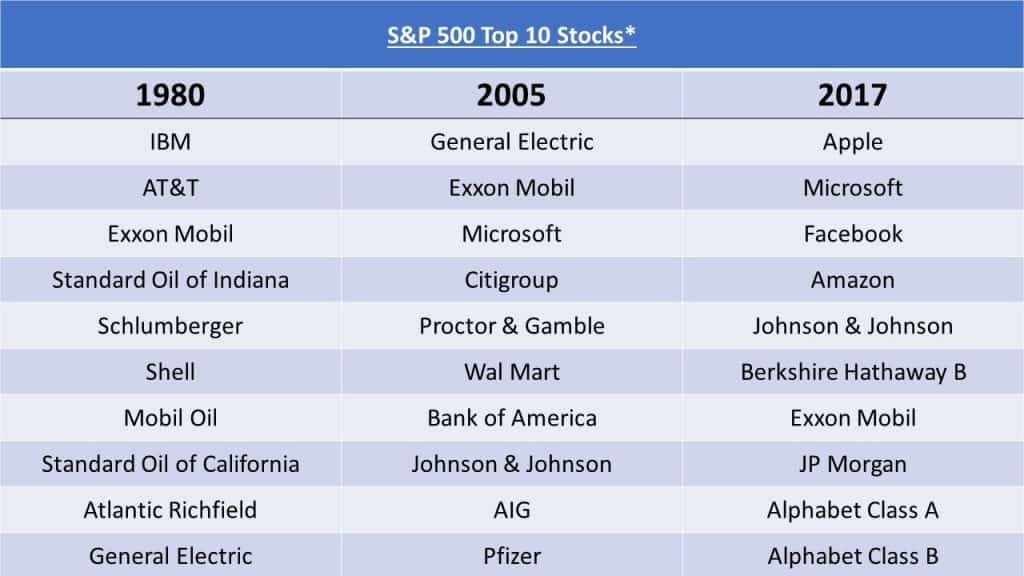

We also see this pace of change reflected in the nature of the businesses that are leading our economy. This can be seen through the shift in the largest companies in the S & P 500 which is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ.

One cannot help but observe that in 1980, 7 out of the top 10 were oil/oil services companies. Just 25 years later we were down to one oil company and even more interestingly, only one company that would have been considered a “tech” company – Microsoft.

Today, 6 out of the top 10 are considered “tech” companies or at least spawned by the technology of the internet. (Alphabet A & B are what was Google) Only one made the lists in all 3 periods, ExxonMobil.

The acceleration driven by continually faster computing power cannot be missed over the past 10 years. If the accelerations continue, what will the top companies be in 10 years or even five years?

So, this is not your father’s stock market in many ways. What does this mean for investors in this dynamically changing world? In our opinion it means some type of dynamism is needed to manage ownership of stocks. Whether one’s assets are invested in mutual funds, individual stocks, or even bonds, investors want to make sure they capture the long-term growth today’s companies will hopefully provide.

Do those stocks you inherited from your father offer you that opportunity? Does that stock you are holding onto because you are waiting for it to come back before you sell have a future? Is your portfolio diversified properly for future growth? In this fast-changing investment landscape it might be worth a check-up.

*ETF Database Mitre Media