To Rent or Buy That Vacation Home?

The snow is flying, and thoughts of a warm weather vacation are heating up. This leads some to the debate over whether to buy or rent. The decision can be confusing but must be what is right for you. So, let’s pause a bit and go through the advantages and disadvantages of owning.

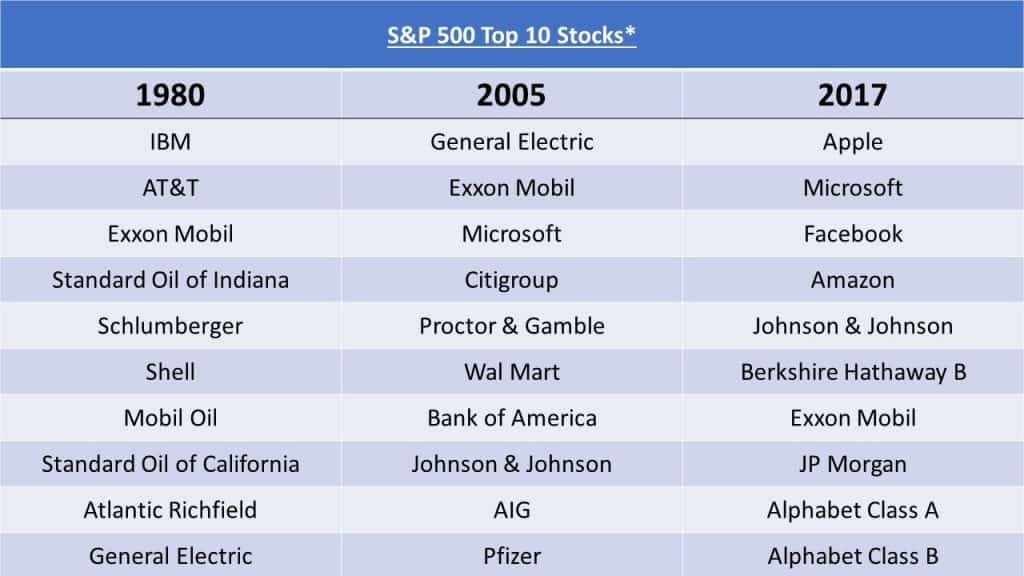

When you buy a home with a mortgage, you are taking money that could go into investments and placing that in a down payment. When you calculate the costs of owning, the opportunity costs of what that down payment could potentially earn in the stock market should be included. You also have other costs of owning a home such as property taxes, upkeep, maintenance and insurance. To determine your annual home costs, you need to add up the opportunity costs, the maintenance and repairs, insurance and the after-tax costs of property taxes and mortgage interest.

Every month, you pay principal and interest on your mortgage; as you pay principal, your ownership percentage of your home’s purchase price grows, and the bank’s percentage of ownership diminishes. In the long run, owning may give you a financial advantage due to increased equity. However, that is only if you stay in the home long enough to recover the costs of selling, and there is no guarantee that the value of the home is going to appreciate.

On the other hand, owning a home has some non-financial advantages to consider. You have more control over your housing future because, while property taxes may rise, you don’t run the risk of management changing or aggressively raising rents. While you can build a community renting, it is often more transient than the community you establish when you own. You also retain more authority over the things you want to do to your home.

But homes are also anchors — psychologically and financially. You may not feel like you can leave a home that has dropped in value. You may end up dissatisfied with your purchase, and now feel stuck. Here is where you can’t treat a home like an investment. If you are unhappy in your home, then figure out how to get out. The financial costs of leaving may be far less than the psychological costs of staying.

Second homes are more perplexing. These are discretionary purchases, similar to a trip. There are rarely financial advantages to a second home. Using the same exercise in cost counting, you would take your total costs and divide by the expected annual nights you will be there. When you do this, most of the time you will find that you could have been financially better off renting or staying in a hotel.

We have had clients who have purchased second homes before they discovered that ownership was not a good fit for them and extricating themselves was costly. If you are serious about spending considerable time in another area, then I encourage you to rent before you buy. This gives you an opportunity to test drive the next stage of your life before fully committing.

Imagine this; your friend is preparing his tax returns and is confused as to why he owes taxes on a mutual fund position that he hasn’t sold, and it went down in value from the purchase price.

Imagine this; your friend is preparing his tax returns and is confused as to why he owes taxes on a mutual fund position that he hasn’t sold, and it went down in value from the purchase price.

urn. It makes sense when you consider that a percentage is the best way to compare how your investments are doing against the broader market, other investment strategies being deployed, or your friends at the water cooler. But we should remind ourselves that we don’t spend a percentage; we spend the account value. While an investor should certainly consider rate of return as a measure for how an investment is performing, one should also be aware of investment strategies that exist not solely to generate the highest rate of return, but rather are designed to result in the most spendable money in one’s life. After all, isn’t that why we’re doing this?

urn. It makes sense when you consider that a percentage is the best way to compare how your investments are doing against the broader market, other investment strategies being deployed, or your friends at the water cooler. But we should remind ourselves that we don’t spend a percentage; we spend the account value. While an investor should certainly consider rate of return as a measure for how an investment is performing, one should also be aware of investment strategies that exist not solely to generate the highest rate of return, but rather are designed to result in the most spendable money in one’s life. After all, isn’t that why we’re doing this?